The fake meat industry is going through growing pains, prompting brands to rethink their product lines and marketing.

The meat alternative category seemed to peak around 2019, with two major companies leading the pack: Beyond Meat and Impossible Foods. Beyond Meat’s IPO gave it a valuation of nearly $1.5 billion. Meanwhile, the company’s revenues hit $406.8 million for the full year 2020, a 36.6% year-over-year increase. That same year, Impossible Foods’ retail footprint increased nearly 100X. These companies tied to further jump start their growth by partnering with major fast food chains and jumping on trends, like releasing their own versions of meatless chicken amid the chicken sandwich wars spearheaded by Popeyes and Chick-fil-A.

But since then, the category has been in a slump, with industry leaders reporting declining revenue, while other startups like Nowadays and and Meatless Farm, have shuttered or had layoffs this year. While some shoppers were previously intrigued by the novelty of these meat alternatives, others have been turned off by underwhelming taste and mysterious ingredients. In turn, newer players in the space are trying to differentiate themselves by marketing their products as a convenience play, while promoting products with natural ingredients that offer easier-to-understand health benefits.

In the second quarter of this year, Beyond Meat reported net revenue dropped 30.5% year-over-year, to $102.1 million. But that was just the latest set of lackluster results from Beyond Meat over the past 18 months. For the 2022 fiscal year, revenue was down 9.8% from 2021 while losses jumped 101% to $366.1 million. Meanwhile its biggest competitor, Impossible Foods, has once again placed its long-anticipated IPO on hold. Impossible does not share sales figures publicly, but said 2022 saw “record sales” and 50% dollar sales growth in retail. However, last year the company also cut its workforce by 130 people to bring costs in line with revenue.

Now, with these industry leaders struggling and mass adoption still lagging behind other better-for-you and plant-based foods, companies in the alternative meat space are now trying to course correct.

Muddled messaging and increased competition

When they first launched, faux meat brands marketed themselves as direct beef competitors that were healthier for the planet, which they believed would be the ticket to becoming a dominant food category. This made for a confusing messaging, especially among people looking to try meat substitutes for the first time.

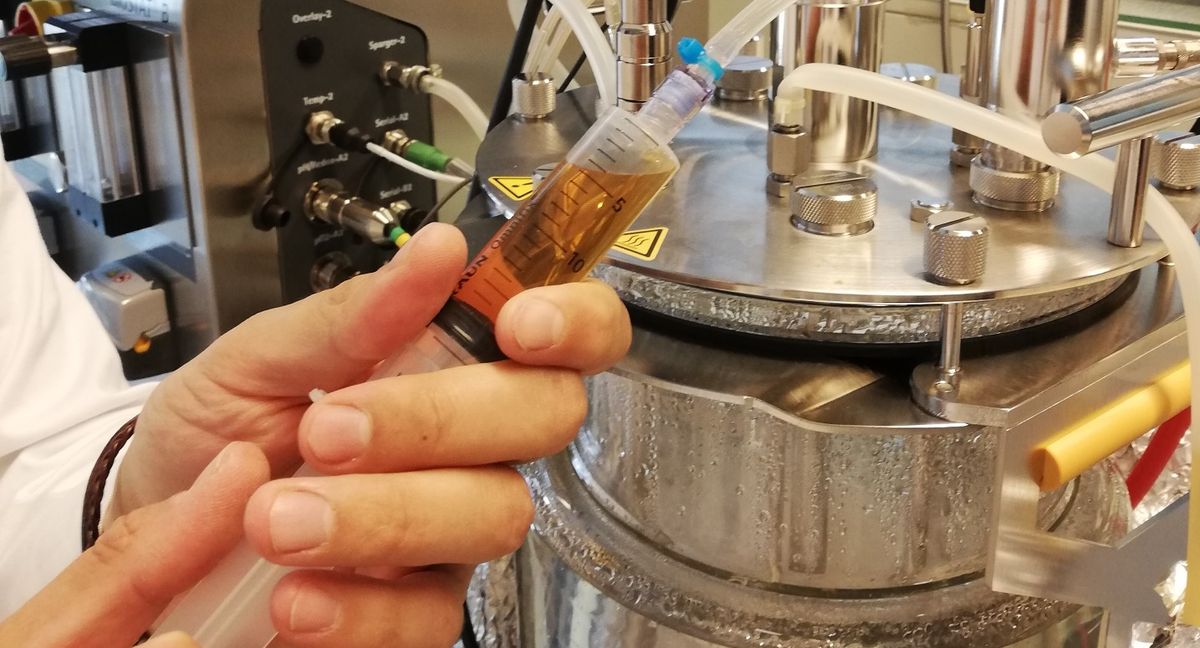

Chris DuBois, executive vp, fresh and protein practice leader at Circana, said that “meat substitutes have caught a lot of attention, but it has never caught more than 2% of the total meat dollar.” He described the recent lab-grown movement in the meat-free category as “wave two,” which built upon the early iterations of frozen veggie burgers of the ‘80s and ‘90s, and attempted to create products that more closely mimicked traditional hamburgers and other meat products. But the industry is now moving into in plant-based 3.0, DuBois said, which entails going back to basics by re-centering natural ingredients while also utilizing modern supply chain technology to streamline production.

** Click here to read the full-text **