You may have seen media coverage about sales of plant-based meat going flat in developed markets. Some have suggested the segment might be “losing its sizzle in the US.”

At Better Bite Ventures, we’ve been analyzing data and looking beyond the headlines at consumer attitudes and possible reasons for the sector’s decline.

We invest across many alternative protein technologies and categories, including cultivated (cell-based) and precision fermentation.

But plant-based meat is an important chunk of the market and deserves deeper analysis.

The trends we cover here are so far most visible outside the Asia Pacific. However, we know from experience that we can learn a lot from looking into more mature markets to see what might be coming our way.

Globally flat sales

Retail sales are flat in key markets across the world, most notably in the biggest market, the US. However, Germany and emerging Asian markets are notable exceptions, though the latter obviously start from a much lower base. Tellingly, Asia’s most developed market, Singapore, is also seeing plant-based meat sales flatline like in most developed markets.

The US retail market has the most accessible and most recent figures: This Financial Times report shows that plant-based meat sales began stagnating in early 2021 after solid growth throughout 2020.

FoodNavigator reports that dollar sales of all frozen and refrigerated plant-based meat were down 1.1% in September 2022 from a year ago. To put this drop in context, the same source shows a 4.1% growth in sales of refrigerated animal meat and a 7.1% rise in sales of frozen animal meat.

No matter how we slice it, at least for now, the market share of plant-based meat is not growing in the US retail market beyond the current 1%-2% (or about US$1.4 billion in value).

Moving across the pond, how is Europe looking?

In the UK, retail data shows the sector’s growth lasted for much longer there, but in the last few months, it has stagnated as in the US.

However, the situation is different in Germany, another top market for plant-based meat.

According to our sources, plant-based meat sales in the first half of 2022 rose 10%-15% year on year, as per data from market research firm IRI.

Based on our conversations with founders, the sector is still growing in emerging markets across Asia – albeit from a comparatively smaller starting point.

In Singapore, a senior representative of a major retail player and a supermarket chain both said the sales of plant-based meat have flattened there too, though neither agreed to go on the record.

Brighter picture in food service

We’ve talked mostly about retail sales so far, but there is another key channel to look into – food service, including restaurant chains.

Not only does it make up a large chunk of the total protein market, but many plant-based brands introduce their products to consumers through this channel before putting them on supermarket shelves.

Reliable data for sales of plant-based meat in food service is harder to get, but anecdotal evidence paints a brighter picture than for retail.

Quick-service restaurants (QSRs) continue to roll out plant-based options and scale them up after initial tests. Here is a quick round-up from the last few months:

- After a year-long trial, McDonald’s made the McPlant burger a permanent addition to its menu at all outlets in the Netherlands starting in October.

- McPlant is now also in Austria, Denmark, Sweden, Portugal, the UK, and Ireland, where the company is “delighted” with the demand.

- However, in the US, McDonald’s “quietly ended” a 600-store test earlier this year. Burger King rolled out a plant-based Whopper across most European markets, and in many countries in APAC and Latin America.

- The marketing manager of Burger King in Belgium was quoted in July saying that “about one in three Whoppers sold [in Belgium] is vegetarian.”

- Domino’s Pizza in Australia and New Zealand has introduced as many as eight new Impossible Pizzas in partnership with Impossible Foods.

Most startups and distributors we talked to said their food service channel continues to perform well.

Plant-based brands like Redefine Meat and our own portfolio company, TiNDLE, have expanded their food service footprint globally and landed major distribution deals. Ikea, the sixth-largest food chain in the world, has pledged to make 50% of its menus and 80% of packaged food plant-based by 2025. Our recent visit to Jakarta confirms that Ikea walks the talk, providing plenty of plant-based meat options supplied by local startup Green Rebel Foods (also part of the Better Bite portfolio).

It might be a mixed bag for the plant-based market overall, however, the lack of growth for plant-based meat in retail still begs the question: Why is this happening?

Hypothesis 1: Pandemic boost and ‘normalizing’

One oft-repeated narrative – at least until recently – has been that the pandemic created an unprecedented demand for plant-based meat, which boosted 2020 sales numbers.

The narrative suggests that the slowdown we are seeing now is just a normalization from elevated levels.

Growth indeed surged during the early months of the pandemic. In the US, some months saw sales grow as much as 40%-70% year on year.

But given that lockdowns and restrictions have been scrapped in most regions for quite some time now, we might expect the trend to have reversed sooner than it did if the sales jump was only due to “the pandemic effect,” instead of lingering into 2021 in the US and even early 2022 in the UK.

Hypothesis 2: Inflation and price sensitivity

Reports from the likes of the Financial Times and Channel News Asia have put the blame on inflation – arguably the most common explanation.

There is no doubt that price matters to consumers and plant-based meat is still much more expensive than that from animals.

The price can be anywhere from 32% higher in the UK and 65% higher in the US to 335% higher in Japan, according to GFI/Kearney data from 2021.

Consumers tend to trade down when under financial pressure, but how strongly is inflation really linked to plant-based meat sales?

In our view, it’s inconclusive. There seems to be some correlation, but the monthly data does not quite line up. In the US, the sales growth reversed around February and March 2021, when inflation was around 2%. It only started to surge in April.

Since then, inflation has gone up to 8%-9%, while sales of plant-based meat stayed flat, though one would have expected a further drop.

Therefore, price and inflation are unlikely to be the only factor contributing to flattening sales.

Hypothesis 3: Taste and texture

One of the food industry’s favorite cliches is “taste is king.” Some add that texture is queen.

It’s not enough for a product to have strong environmental and health credentials – if it does not taste good, people will not buy it.

One thing that consumers seem to recognize is that plant-based meat has gotten much better in the last few years but the sensory gap compared to animal meat remains significant.

Researchers from Michigan State University, the University of Parma and Wageningen University, have published one of the most insightful studies on the issue.

In a blind tasting, the 100% animal beef burger was rated 6.95 on average on a scale of 10, while the Impossible Burger (soy + heme) got a score of 5.10, and the Beyond Burger (pea protein) was rated 3.73.

The working theory here is that many consumers tried plant-based meat for the first time, driven by brands trying to convince them it tastes “as good as [animal] meat.” But the initial hype has flooded the market with mediocre products. So they are not meeting high expectations, and consumers are not coming back to purchase again.

Hypothesis 4: Health and nutrition

Nearly all consumer research points to health being the main incentive for people to consider plant-based meat. It needs to taste good, but people also expect it to be healthier than the animal-based option and have a similar or better nutrition profile.

In this study, covering four selected Asian markets (China, Indonesia, Thailand and Japan), all the top reasons for consumers to buy plant-based meat were related to health and nutrition.

In the early years of the “new generation” of plant-based meat, most media coverage focused on novelty, tech, and lower environmental impact. At the same time, the media talked about the health benefits of a plant-based diet. Startups in this emerging sector also often focus on health claims.

Then the media narrative gradually shifted, possibly affecting how consumers feel about this sector and whether they decide to make a purchase. Headlines started asking: “Are these products healthy?”

Articles pointed to long ingredient lists and nutrition labels. The term “ultra-processed” has also been thrown around.

This narrative shift is driven by actual nutritional deficits and perception issues but also the meat industry’s agenda as well as the mechanics of modern media, which can make discussing these issues with nuance challenging.

Deloitte reports that, as a result, the number of people who believe plant-based meat is healthier dropped by eight percentage points between 2021 and 2022.

So are these products nutritious or not? There is still a lack of good independent research, specifically that comparing health effects of diets with a high share of plant-based alternatives, though there are some attempts to review existing studies in the field.

Hypothesis 5: Adoption models

It’s also worth looking into how innovations are typically adopted by the market.

Catherine Tubb is director of research at Synthesis Capital, one of the largest alt-protein and foodtech funds based in Europe. She has previously co-authored the often-referenced RethinkX report. Tubb has also recently published a piece on this exact topic.

She believes the plant-based meat market is at a pre-tipping point of the S-curve adoption cycle.

According to this framework, the adoption rate is much slower (and lumpier) in the first phase of growth, when it is driven by “early adopters.” Then the tipping point occurs and the adoption accelerates dramatically, attracting mainstream consumers. Ultimately, it slows down and stagnates when the market is mature.

The key question is: where are we now in the adoption cycle for plant-based meat?

Sales penetration would indeed suggest we are still in the early stages – even in the most developed markets, plant-based meat does not hold more than 1%-2% of the total market share for proteins in dollar terms.

On the other hand, data also shows high awareness and trial rates in the US, where 19% of US households purchased plant-based meat in 2021.

Which of these metrics should we be looking at? Is a category with 19% penetration at a “pre-tipping point?” It is unlikely that’s how we would describe TV sets or electric vehicles if nearly 20% of households had them. But maybe we should see it differently for consumer packaged goods products? It’s a topic worth further exploration as we see value in studying the way consumers and societies adapt innovations and new behaviors and applying it to the protein transition.

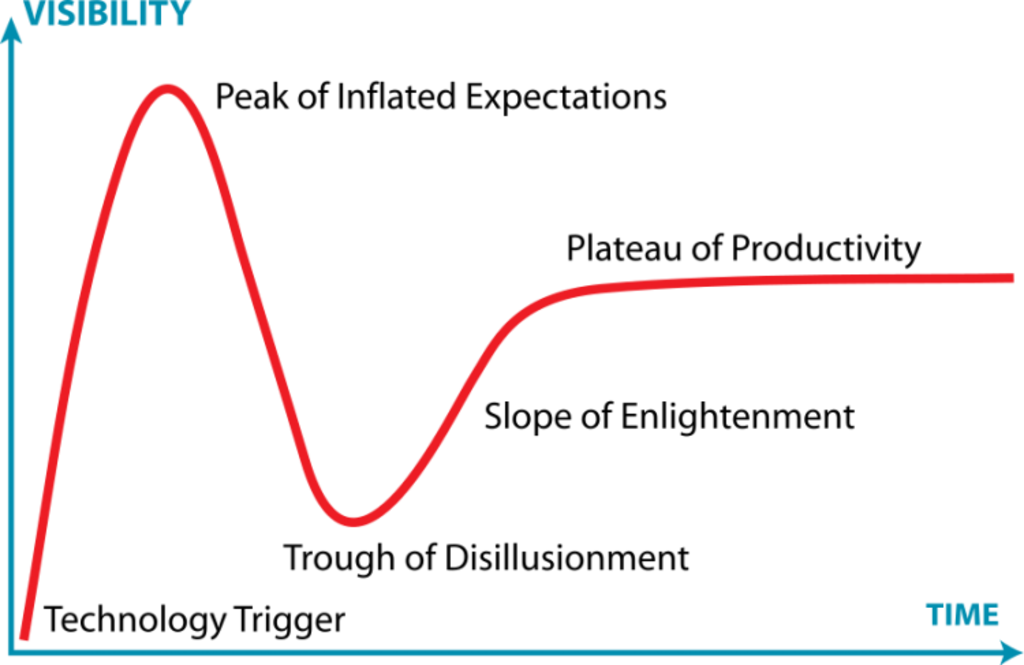

One more adoption framework that may apply here is the popular Gartner hype cycle:

The hypothesis suggests that overly bullish narratives from the industry and media led to a “peak of inflated expectations,” while products were not good enough. And that we are now in the aptly named “trough of disillusionment.”

Our working theory

So what is the actual reason behind the flat sales trend of plant-based meat? Is it cost, taste, or health? Our best answer, for now, is all three.

Most consumers will not want to pay a premium for a product that they perceive to be inferior in taste and texture, and what they see (rightly or wrongly) as having less nutrition than they desire. However, we believe each of the key areas can be addressed.

Increased volumes and economies of scale, combined with pressures on animal meat production (like a carbon/methane tax), should lead to price parity in the near future – and then dip below, making plant-based options consistently cheaper.

Emerging technologies like mycelium/fungi and hybrid products combining plant-based and cultivated meat or precision fermentation ingredients will elevate the taste/texture experience.

On health and nutrition, improvements have been made by some startups in the latest versions of their flagship products, reducing fat and sodium – and more should be done. New studies will likely come out, directly comparing the health outcomes of animal and plant-based meat consumption, which may influence the narrative around these topics.

We believe the industry is still in its infancy. The fundamentals driving the transformation remain strong – more sustainable protein production is key to addressing climate change and biodiversity loss. Many dedicated founders, investors, nonprofits and industry leaders are working to address these problems and come up with solutions.

Our fund is also in an early phase of a decade-long journey. As the saying goes, people tend to overestimate how much can be done in one year, but underestimate how much it is possible to accomplish in 10 years.

This article originally appeared in the Future Food Now newsletter.