After explosive growth pre-pandemic, sales of meat alternatives fell last year

After exploding onto

While the company’s plant-based products that sell under the Lightlife, Field Roast, and other brand names booked almost $45 million in sales in the first quarter of this year, they “no longer expect spectacular category growth rates,” it told investors in announcing financial results last month. “We do see the plant category growing, but at a steady pace,” which is why the company plans to repurpose some of its plant-based factory space to make meat products again.

The company still thinks its plant-based meat business is on track to ring in up to $10 billion in sales within the decade. But that’s less than half what it was anticipating before.

Industry-wide, the sales slowdown is partly caused by the same inflationary and supply chain problems that the entire food business is dealing with. And consumers are proving to be less willing to swallow higher prices.

The scene as the next big thing in food, the plant-based meat trend has come back down to earth of late as consumers and investors discover that, behind all the sizzle, there’s not a lot of steaks.

The poster child for the trend is Beyond meat, the meat alternative company whose highly touted IPO in 2019 saw it more than double in value on its first day.

The business case was simple: For economic, environmental, and health reasons, people worldwide would soon decide to eat less meat and instead consume plant-based proteins.

Beyond meat had developed a burger patty based on pea proteins that tasted like real meat, flying off the shelves. Other products designed to mimic chicken and pork soon followed, and investors piled into a company that seemed well on its way to hundreds of billions of dollars in sales.

But it hasn’t worked out that way. According to analyst Jennifer Bartashus at Bloomberg Intelligence, after growing by 13 percent in 2019 and almost 40 percent in 2020, sales of meat alternatives at the five biggest North American producers slipped by four percent last year.

That’s a group of companies, including Canada’s Maple Leaf Foods, which jumped into the trend in 2019 when it committed $310 million to build a massive new factory in Indiana to produce meat alternatives.

Rising prices

Anyone who has been into a grocery store recently knows that the price of food is going up quickly, and of meat in particular.

Statistics Canada data showed that meat prices rose more than 10 percent in the year up to April. But meat alternatives haven’t been able to benefit from the growing consumer trend to save money on food because they’re up sharply, too.

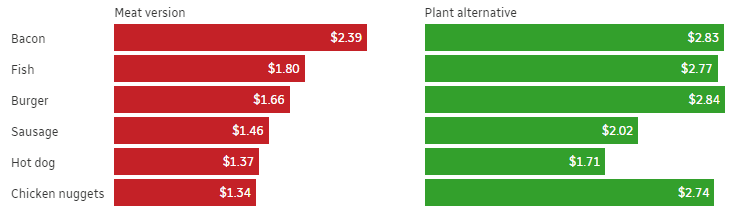

Sylvain Charlebois, director of the Agri-Food Analytics Lab at Dalhousie University in Halifax, calculated in a recent report that plant-based meat is, on average, 38 percent more expensive at the retail level than its meat-based alternative.

Plant-based eating offers no respite from inflation

This chart shows the average retail price for 100 grams of various meat products in April 2022

The gap is widest for things like chicken nuggets and burger patties, but even comparatively cheaper items like bacon and hot dogs have a premium price attached to them for plant-based versions.

“With a very high inflation rate, a lot of people are looking for bargains. But if you’re actually looking at plant-based products, that’s not what you’re getting,” he said in an interview. “These products may be good for the environment and good for your health, but they’re certainly not good for your budget.”

Despite those cost considerations, Bloomberg’s Bartashus still thinks there’s lot of room for growth to come and is forecasting sales for all plant-based meat products to grow from about $30 billion today, to almost $170 billion by 2031.

That would be about 10 percent of what the world spends on protein every year, and a big reason for her optimism is the environmental argument.

“Concerns about sustainably feeding a growing population are driving interest in plant-based products that can serve as a replacement for conventional proteins,” Bartashus said in a recent report to clients.

- Beyond Meat stock more than doubles on first day of trading

- Oatly’s blockbuster IPO shows healthy appetite for plant-based living is growing

“We expect growth for plant-based meat and dairy alternatives will outpace conventional products, supported by innovation, increased production capacity, lower prices, broader distribution gains, and consumer acceptance.”

Others are not convinced that plant-based eating is anything more than a trendy food craze that may have run its course. “Three years ago, we were seeing these large sales … to a very large number of consumers that were very curious and wanted to try it out,” said Simon Somogyi, a professor who studies the food business at the University of Guelph. “But the true marketplace is showing itself now.”

- We’ll all be paying a lot more for food next year, says Canada’s Food Price Report

- ANALYSISInflation biting into your grocery bill? Follow the food from farm to fork to see why

While vegetarianism is a steady and growing force in the food business, Somogyi says most people interested in plant-based eating are happy to eat more fruits and vegetables and conventional proteins like beans and lentils, as opposed to factory-made plant products that masquerade as meat.

“They were all the rage and consumers were curious to try them out, but now they’ve tried them and that fad has sort of worn off,” he said.