- CellX and Bluu Seafood will jointly work towards gaining regulatory approval and expand consumer acceptance of lab-grown protein products in China and Europe

- Investments in cultivated meat companies more than tripled to US$1.38 billion last year, while cultivated seafood firms saw inflows rise over twofold to US$115 million, according to Good Food Institute

A Shanghai-based cell-grown meat start-up has joined forces with a European cultivated seafood company to address future demand for sustainable animal protein.

The strategic partnership between CellX and Berlin-based Bluu Seafood in April would help both companies drive regulatory compliance and expand consumer acceptance of lab-grown protein products in the Chinese and European markets, their founders said.

The companies envision joint activities ranging from procuring raw materials, construction of production facilities and even sales tie-ups, said Simon Fabich, co-founder and managing director of Bluu Seafood in an emailed interview.

“To secure the future supply of animal protein for a growing world population, new approaches to food production are needed,” said Fabich.

Around 660 million people may still face hunger in 2030, in part due to lasting effects of the Covid-19 pandemic on global food security – 30 million more people than in a scenario in which the pandemic had not occurred, according to a report by the United Nations in July.

“What we are solving is a global issue, and this needs a global solution,” said Ziliang Yang, co-founder and CEO of Shanghai-based start-up CellX in a phone interview. “There are lots of challenges [in the supply chain], and I don’t think any company can thrive single-handedly. There is definitely a need for the industry to come together, collaborate, and share knowledge to solve these issues,” said Yang.

Cultivated meat and seafood are a critical piece of the puzzle in the shift to a sustainable, secure and just food system, according to Caroline Bushnell, vice-president of corporate engagement at the Good Food Institute (GFI) in their Cultivated Meat and Seafood 2021 State of the Industry report released in April.

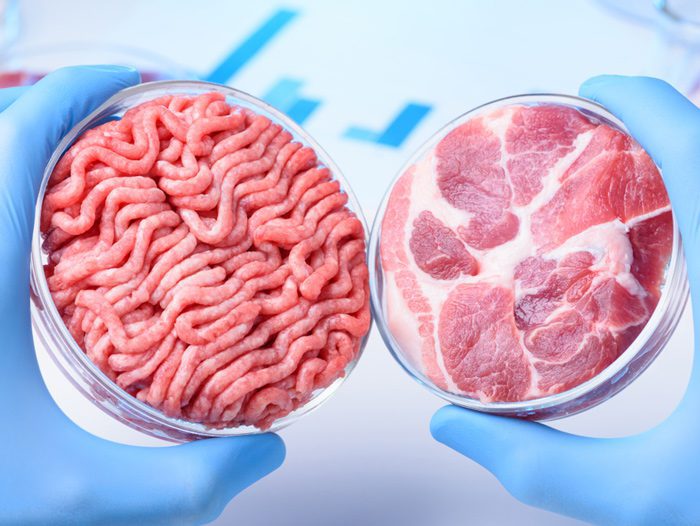

“The promise of cultivated meat is its indistinguishability from conventional meat – from each bite all the way down to the cellular level. And since the technology behind it offers a means of meat production that can be decarbonised, cultivated meat provides a compelling way to heed the climate community’s call to ‘electrify everything’,” said Bushnell.

Cultivated meat produced using renewable energy can cut carbon footprint by up to 92 per cent and up to 95 per cent reduction in land use when compared with conventional beef, according to the GFI.

Beef production is an extremely carbon intensive process because of the methane emitted by cattle during the digestive process.

“I have been a flexitarian for the past seven years, and I know how hard it is for someone to transition from being a meat-lover to just a plant-based diet altogether,” said Yang. “I think it could be difficult for the entire world to adopt [a plant-based diet]. We need to provide options that better mimics actual meat. That’s why there is a need for cultivated meat to exist.”

Investments in cultivated meat companies reached US$1.38 billion last year, more than tripling from US$410 million in 2020, according to GFI. Meanwhile, investments in cultivated seafood companies reached US$115 million in 2021, more than doubling from US$53 million in 2020, accounting for 66 per cent of alternative seafood investments last year.

The global cultivated meat market could add an additional US$5 billion to the estimated US$20 billion in market value by 2030 if companies sell into key regions like China, according to the 2021 State of the Industry Report.

“We want to be the first company to bring cultivated meat to the Chinese consumer, and we also want to be the first Chinese company to bring this abroad as well,” said CellX’s Yang.

“Having the partnership [with Bluu Seafood] can help us establish ourselves abroad and to receive regulatory approval in other countries,” said Yang, adding that they hoped to get product approval in Singapore, US and European markets.

CellX, which had raised around US$5 million by September 2021, will be announcing their newest funding soon.

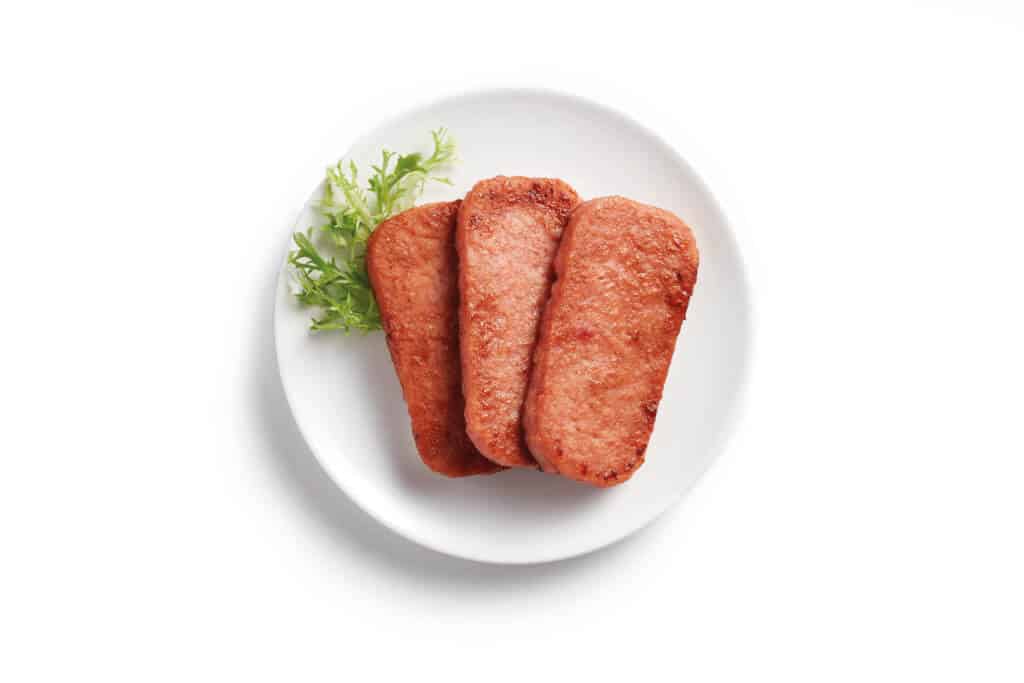

“We started with pork, but we have expanded to different species since the platform technologies enable us to have a multi-species strategy,” said Yang. “We plan to showcase our latest development, which will potentially include [cell-based] chicken and beef, at a public tasting later this year in Shanghai after the lockdown.”

Bluu Seafood also plans to present their first product consisting of a mixture of cultivated fish and plant-based proteins by the end of this year, aiming for regulatory approval by the end of 2023, said Fabich.