To many of Midwesterners raised on meat and potatoes, having a salad means adding lettuce to your quarter-pound hamburger. However, the recent influx of plant-based meat alternative products is causing concern for meat-loving livestock producers.

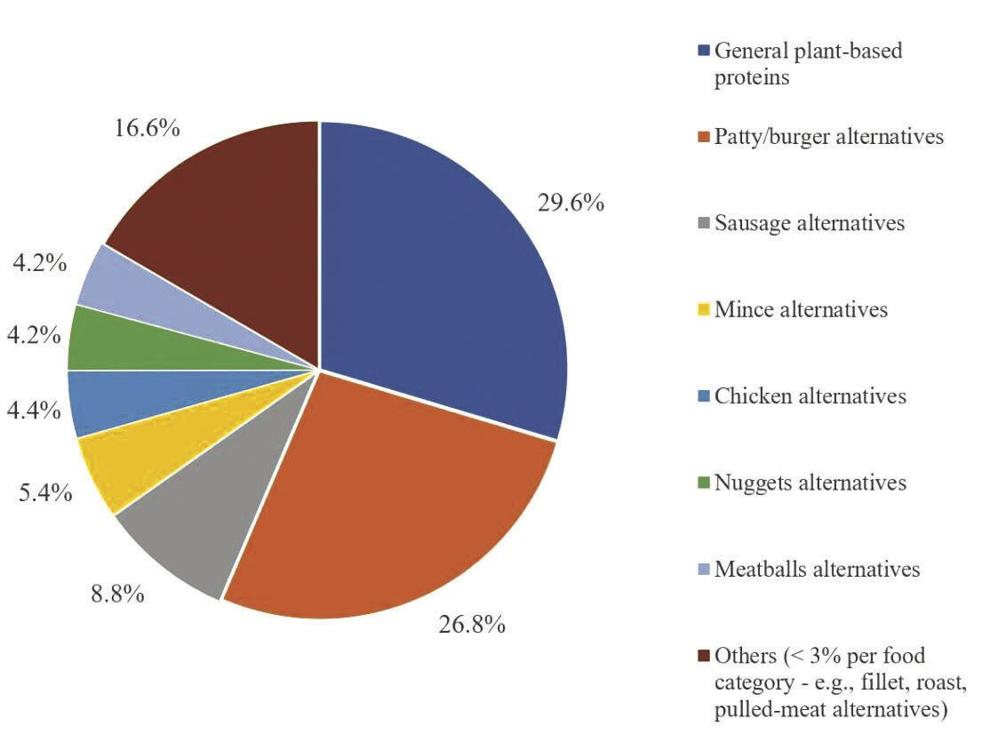

There is an obvious antagonism between the two industries. Plant-based burgers, sausages, meatballs, chicken tenders and pork chops imitate animal meat in appearance, taste and texture. More often, advertisements for these products no longer target vegans or vegetarians; rather, they are aiming to attract a new generation of consumers by focusing on issues surrounding health and ethics.

Whether you choose to eat plant-based foods or not, all within agriculture are affected by the plant-based meat alternative (PBMA) movement. Livestock producers may view it as a threat to their market share, whereas pulse crop and dry bean producers eagerly anticipate increased demand for their commodities that are turned into alternative proteins. Even corn and soybean farmers are an essential part of the plant-based equation.

A growing number of companies are investing in and manufacturing the products, giving companies such as Impossible Foods and Beyond Meat competition. In the United States, the 2022 plant-based food market was worth $8 billion, according to the Good Food Institute.

The push toward plant-based diets has been increasingly endorsed by health officials and environmentalists alike for the perceived benefits to health, animal welfare and sustainability.

Discussions about both the animal protein and plant-based industries are surrounded by stigmas and many unknowns. One question stands out: can animal meat protein and plant-based meat alternatives coexist?

“Yes they can, based on the fact that they already are,” said Colin Woodall, CEO of the National Cattlemen’s Beef Association (NCBA).

The following will examine different aspects of both plant-based meat alternative manufacturing and animal production, as well as how consumer expectations are driving the entire food system toward sustainability.

Consumers drive demand

Because of the weight the consumer pulls in this conversation, it’s important to examine their role in the dynamics between animal meat and alternatives. According to the Good Food Institute, the plant-based meat market is about 1% of the United States retail meat market.

Plant-based manufacturers are seeking to broaden their market and entice meat eaters to consume plant-based foods by appealing to young flexitarians and omnivores, as stated in a Jan. 15 article from the National Library of Medicine. A flexitarian is defined by the Good Food Institute as “flexible and vegetarian.” This group of consumers makes up one-third of the U.S. population.

Flexitarians are more interested in protein alternatives to reduce or replace meat intake, whereas heavy meat eaters “might be less willing” to consume alternatives, as affirmed by several studies cited in the National Library of Medicine.

Furthermore, “vegetarians and vegans are not seeking sensory properties in plant-based products.” This is based on the premise that those who choose a sans-animal diet do want their food to resemble meat. This concept was summarized by Matt Durler, vice president of Animal Feed Development at ICM Inc., which provides separation technologies for two-thirds of domestic ethanol production in the United States and one-third of the gallons worldwide.

“Vegetarians eat plant-based foods and wouldn’t consume steak anyway,” he said.

Because of this, he believes plant-based protein could potentially erode the market share but is not a specific threat to the meat industry.

Catering to the taste buds of flexitarians poses challenges for meat alternative manufacturers, as outlined by the National Library of Medicine article: “To achieve acceptability by a wider audience of meat eaters, the new generation of PBMAs shall be developed in a way that texture, appearance, aroma and taste resemble those of equivalent authentic meat products, before, during and after cooking.” The dominant marketing strategy of meat alternatives is to mimic traditional meat as closely as possible, from storage to consumption.

This group of consumers eating meat alternatives is seeking the taste and satisfaction of a real meat pork chop or burger without the perceived negative environmental or health connotations. Therefore, the sensory attributes of the meat alternative must align with consumer acceptance of production practices. From the plants grown in the field to the plant-based patty created at the food manufacturer, each stage of food production is being analyzed by consumers.

Tim McGreevy, CEO of the USA Dry Pea and Lentil Council and American Pulse Association, described what concerns today’s consumers.

“Consumers, especially the younger generation having kids, are very conscience of what their peers are interested in,” McGreevy said. “They are looking at where their food is coming from, how their food is produced and what impact it has.”

** Click here to read the full-text **