Biotech startups are finding it hard to source lab space in London. Incubators such as Scale Space in the White City hub aim to ease up the pressure by opening flexible lab leases in the city.

The COVID-19 pandemic has hammered home the importance of biotechnology in society. As a result, the last few years have seen skyrocketing funding going to biotech companies and life sciences-focused venture capital (VC) firms around the world. In 2022, funding is harder to come by for biotech companies than in 2021 as public market woes ripple out to private biotech funding, but a lot of cash remains to be deployed in the space.

“There has been huge investment into the life sciences sector, supporting companies that are tackling some of the key challenges of our generation, ranging from solutions to mitigate climate change to breakthrough cancer treatments,” said Michael Holmes, CEO of the U.K. business incubator Scale Space.

Startups surge in the U.K.’s Golden Triangle

The financing boom for the biotech industry has been accompanied by an upswell in new life sciences companies in the last few years. This is especially the case in the U.K., one of Europe’s leading biotech strongholds. According to a report from the real estate service provider JLL, the rate of U.K. biotech startup formation has more than doubled compared to a decade ago, driven by factors including more plentiful funding and improvements in university tech transfer operations.

The U.K.’s surge in biotech companies isn’t evenly distributed, however; the lion’s share of this activity is happening in the famous Golden Triangle encompassing Cambridge, Oxford and London. Meanwhile, the rest of the country has seen much lower growth in life sciences companies.

The lab space crunch

As the number of life sciences firms grows, this creates more demand for space to set up and do lab work. This is leading to a shortage of lab space.

“Biotech startups typically operate in space which is already full – often these are university labs, or incubators, which in general are oversubscribed,” said Holmes. He added that these startups “typically use their network to find out what space is available; in many cases their investors will support in the search. Many of the companies we have engaged with appear to have no viable options in desirable locations.”

This phenomenon isn’t limited to the U.K. While the U.S. generally has more space to accommodate scaleups and startups than Europe, it is still heavily constrained, said Paddy Shipp, director office & head of U.K. life sciences agency at JLL. The U.K. leads the rest of Europe in terms of space for startups and scaleups because the U.K.’s lab facilities are often privately owned, commercially operated spaces.

“In contrast, space in the remainder of Europe, with perhaps the exception of the Netherlands, has historically been large corporate- or owner-occupied facilities or publicly-owned space such as incubators,” said Shipp.

“For example, most of the science parks [in the rest of Europe] are owned by universities, public research bodies or local governments. As such, most of the startup activity is driven by these organizations and focuses on local provision of space for them.”

Nonetheless, the U.K. is still suffering from the lab space crunch, especially in London. Growing life sciences companies typically don’t have the funding runway to lease and fit out their own labs, and landlords often won’t take on the capital risk with unproven tenants.

In the case of the hygiene testing startup FreshCheck, the founders felt lucky to be able to set up in Imperial College London’s White City incubator.

“At the time we were setting up, we only looked at one other location and they treated us as if we were fully established and knew all the ins and outs of renting a lab facility,” said John Simpson, CTO of FreshCheck. “At the time it was quite daunting and it just didn’t feel like a good fit. They were also less flexible on cost and scaling options.”

In addition, going outside of the London zone isn’t a viable option for many biotech startups.

“The only other similar region is Cambridge, with their own science parks and talent pool that support startups, but Cambridge also has very limited space availability for early biotech companies,” said Reka Tron, COO and co-founder of the cultured meat specialist Multus Media, which has also set itself up in the White City incubator. “You really need a community of companies for support at the beginning of a startup’s life, so going to a major biotech innovation hub makes all the difference.”

Incubators meeting demand

There are efforts to expand the available scaling up space for biotech startups in London. Earlier this year, for example, the Canary Wharf Group and Kadans Science Partner set up a joint venture to develop a central life sciences hub of around 70,000 square meters (750,000 square feet) in size. University College London (UCL) has its own startup incubator in the Camden area called the Hatchery. And over the last five years, the White City incubator in South Kensington has been progressing leaps and bounds in supporting the next generation of biotech startups.

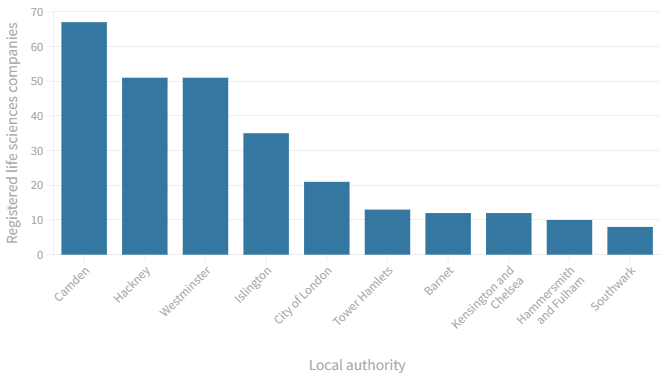

Most popular London local authorities for registering life science companies

Since 2021

Companies filtered using the code “72110 – Research and experimental development on biotechnology”

“Setting up in White City was actually surprisingly easy,” reflected Simpson. “We needed quite a bit of expensive equipment which was very conveniently already provided and shared with other teams. The startups we share the lab with also helped us to understand the nuances of the day-to-day points such as where to take waste or which specific contractors to use.”

Tron agreed, explaining that the White City incubator “made it so much easier to start expanding our company, our space and our team, and really to develop the technology in a suitable environment. If it hadn’t existed, we would have had to look for other incubators because we didn’t have the budget at that point to set up on our own from scratch.”

Having a close-knit community within the incubator leads to productive discussions, such as regarding the best suppliers, couriers and sources of marketing advice. In the last few years, the White City incubator has also launched more services for biotech startups, such as drop-in sessions with experts in finance, intellectual property and human resources.

“This is incredibly valuable for early-stage companies, and we’ve also found it really helps to sanity check our own processes,” explained Simpson. “More services are being brought in regularly, which is really aiding the White City startup culture.”

Scale Space delivers flexible lab space

In the mission to meet demand for office and lab space, Imperial College teamed up with the digital venture builder Blenheim Chalcot in 2020. The result was Scale Space, an 18,500 square meter (200,000 square foot) facility able to house scaleup companies in the tech, digital and life sciences sectors.

The Scale Space facility is geared toward designing and fitting out labs in the White City innovation park and offering them with more flexible terms than many property leases. “What we are able to offer at Scale Space is an affordable ready-to-go lab solution, with no up-front capital investment required, in one of the most exciting innovation districts in London,” said Holmes.

One way that Scale Space aims to make it easier for biotech founders is by making its lab space easily modifiable for their individual needs. Other provisions include shared equipment rooms, meeting rooms and networking events. In 2022, the facility delivered around 1,500 square meters (16,800 square feet) of lab space, which was swiftly occupied, and plans to offer an additional 2,200 square meters (24,000 square feet) in 2023.

“Startup life sciences companies have everything they need to be successful, whether that is space to grow, support services, networks, access to talent, access to Imperial’s knowledge and research, and so on,” explained Holmes.

Planning out a biotech lab

Even with various initiatives ongoing to free up space for budding startups, entrepreneurs must think carefully when it comes to securing lab space and keeping their budget on track. There are many different lab space models that might fit the business, and not all incubators might allow a company to grow from renting a single lab bench to occupying a whole wing of a building.

“If you think you can rapidly prototype a new product then I would try to keep costs low, so look at a short-term small rental and then you can improve your valuation and find a more permanent location,” advised Simpson. “If you are planning to design and develop a whole new pharmaceutical, then you are likely in this for the long haul so make sure your space has all the equipment and lease times you need to bring your dream to reality.”

Tron, in turn, placed emphasis on reaching out to all incubators and early startup spaces to find a spot and making sure there is good access to talent and larger equipment access. “And get to know as many biotech entrepreneurs as possible,” she commented. “It’s a small network and everybody is super helpful.”

As increasing numbers of startups and incubators are added to the biotech map, this creates many opportunities for biotech founders to rub shoulders in small communities. As a result, we could see innovations benefitting many sectors, including in healthcare and industrial biotechnology.

“There are a number of really amazing technologies, especially in the foodtech space, using many tools that used to be reserved for biomedical research now to make something that will be a part of our day-to-day lives,” remarked Tron. “I am really excited to see how different synthetic biology innovations will scale in the future.”